Carbon credits are an element used to aid in the regulation of the number of gases that are being released into the air. This is part of a larger international plan which has been created in an effort to reduce global warming and its effects. The plan works by capping the number of total emissions that can be released by one company or business. If there is a shortfall in the number of gases that are used, there is a monetary value assigned to this shortfall and it may be traded. These credits are often traded between businesses. However, they also are bought and sold in the international markets at whatever the determined market value for them is. There are also times when these credits are used to fund carbon reduction plans between trading partners. As previously stated, the central idea is that using these credits will eventually mitigate the effects of global warming. Some detractors claim, however, that the plan does more to make money for its developers than it does to save the earth from itself. Most countries of the world participate in the credit program. The main formal mechanism is part of what is called the Kyoto Protocol. The goal of the group is to meet emission reduction targets. Over 170 countries make up part of this agreement. The United States has signed the protocol but not ratified it. This is not due to disagreement with its principles. Instead, concern has primarily been expressed over specific exemptions it holds as well as on the effect it would have on the U.S. economy.

There are a number of countries that work with people who are interested in decreasing the size of their carbon footprint in an effort to help save the environment. These people are not mandated to use carbon credits, but they are adamant about using them in the right way. Many companies will sell the credits to such individuals who want to try to make a difference. Although the process that must be followed is somewhat complex, essentially what happens is that carbon offsetters will buy the available credits from an investment fund or from a company that specializes in carbon development and has combined all of the credits obtained from a number of individual projects. Carbon projects may focus on such areas as reforestation, fuel-switching, carbon capture and storage, and energy efficiency. Many major examples deal with renewable energy options. For instance, the focus may be placed on creating and advancing wind turbines for wind power or working with biomass for the creation of biofuels. Solar panels, solar lighting, and solar heating are also important alternative energy areas. In many ways, the actual quality level of these credits is based in large part on the validation process of the fund development group that is sponsoring the project. A certain level of trust must be placed in these companies that they are managing the credits in the proper manner. The main reason why this whole project has come about is because of the burning of fossil fuels by industries across the globe. Proponents of the program claim that using carbon credits will make companies more responsible and will even make some companies more money if they manage the credits properly.

We all have a way of life, and while some of us can afford to put solar panels on our houses, there are still emissions produced from everything we do every day, from the production of the clothes you wear to the furniture you sit on, and from the food you eat to the services you consume. Besides, we don’t all want to drive a hybrid car and become vegetarians. So what can we do?

What is Carbon Trading?

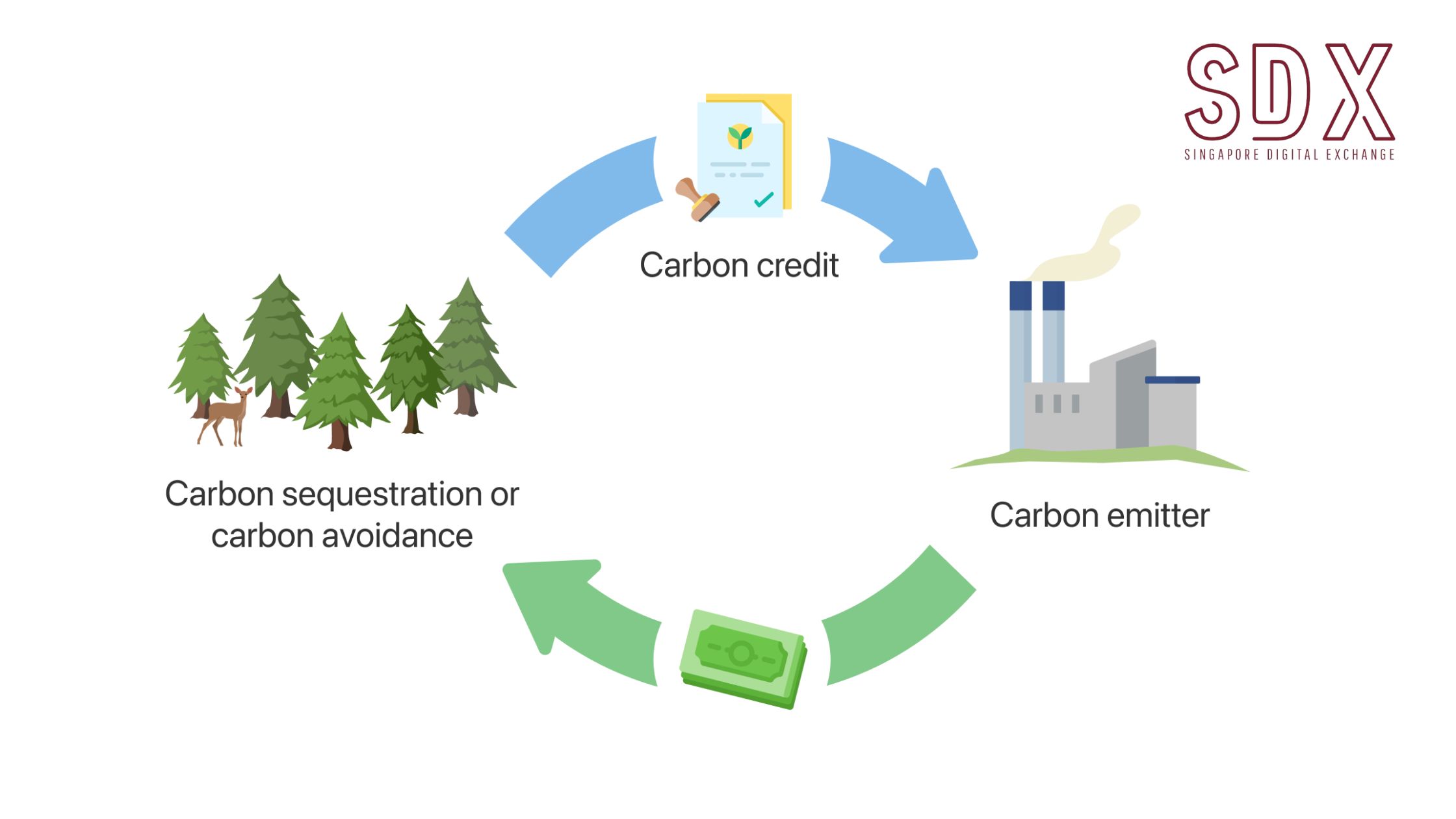

Carbon trading, or carbon offsetting, is a way to balance or compensate for carbon emissions in one geographical place, with a reduction in emissions in another. Since it doesn’t matter where Greenhouse Gases (GHG) are emitted, as their effect on climate change is global, reducing emissions in Brazil or Italy is as effective as doing so locally. ‘Carbon emissions’ refers to carbon dioxide (CO²), and are a form of GHG, as is methane and nitrous oxide, but for most of us, it is easier to think in terms of carbon emissions. It’s completely voluntary, but in 2011 it will become compulsory for some industries. While we do need to reduce our personal carbon emissions and stop being wasteful, some emissions are currently unavoidable, so carbon offsetting is the way to compensate for those emissions we cannot stop. Little things, when done by millions of people, can make a big difference, and carbon offsetting reduces emissions with a minimum of effort and cost. Offsetting means paying someone else to reduce CO² in the atmosphere on your behalf. In that way we pay for the damage we are causing and the money stimulates the development of green technologies that we desperately need.

What is a Carbon Credit?

Carbon reduction projects throughout the world create a tradable ‘carbon credit’ for every tonne of carbon dioxide equivalent (CO²-e) that is stopped from entering our atmosphere. When you buy credit, it is then ‘retired’ so it can’t be sold again – the credit will be recorded against your name, meaning that you have stopped one tonne of CO²-e that otherwise would have entered the atmosphere. There are many different kinds of carbon credits. Certified carbon credits are created by government-approved abatement projects. These include projects such as harnessing landfill gas, reforestation and sequestration, and electricity consumption reduction. Beware: because there are plenty of people claiming to produce carbon credits, but they are in fact not accredited, nor are they even measured properly. You might be paying someone for nothing And how much does it cost? Generally, a carbon credit is $20, though this will probably rise. The Government will be setting a cap on its carbon credits at $40. So, currently, if an average Australian household emitting 20 tonnes of CO² wants to go ‘carbon neutral, it would cost $400 per annum. The equivalent would be to plant about 80 trees.