Cryptocurrency is digital cash. This sort of cash uses blockchain technology, which is secure because it is prepared for developing dispersed arrangements even among scheming social events. Cryptocurrency blockchains seem to be more seasoned style bookkeepers’ records; of course, the record is electronic, and everyone with access to the record can similarly be the agent.

Investors overall have put and are starting to place assets into cryptocurrency. While Bitcoin is sensible and the most well-known computerized cash, a considerable number of advanced monetary standards at this point exist. Cryptocurrency can be viewed as one of the freshest and most intriguing assets open to investors.

Understanding Cryptocurrency Investing

You might contemplate purchasing and holding something like one crypto coin when you consider investing in cryptocurrency. Purchasing cryptocurrency is a logical and the unique technique for adding crypto receptiveness to your portfolio; however, to invest in cryptocurrency, you must take decisions carefully.

Buying cryptocurrency

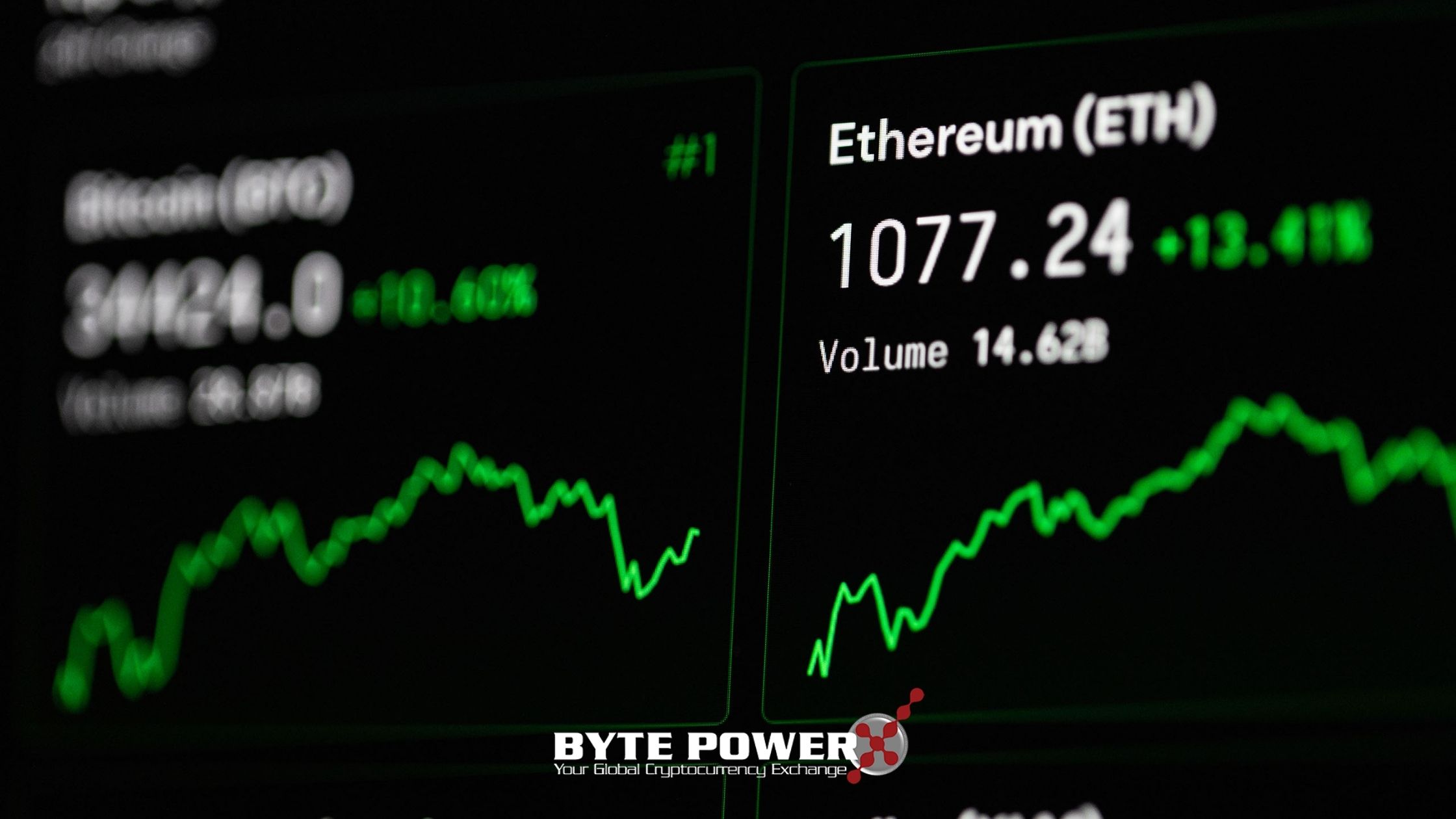

You can choose to buy and store them in the encrypted wallets available on secure and credible exchanges. Your decisions range from the most settled computerized financial norms like Ethereum and Bitcoin to, in every practical sense, dark coins that are transacted and distributed in a fundamental coin offering (ICO).

Ether, Shiba Inu, Dogecoin, Bitcoin, and other cryptocurrencies for buy, sell, and trade you can use Singapore Digital Exchange. It is the number one exchange platform in Singapore.

Put assets into cryptocurrency platforms

Your decisions consolidate cryptocurrency mining companies mining gear makers, associations like Robinhood Markets, Inc. (HOOD) and PayPal Holdings, Inc. (PYPL) that help cryptocurrency, and various others with moving levels of crypto receptiveness. Moreover, you can place assets into associations like MicroStrategy Incorporated (MSTR), which hold a great deal of cryptocurrency on their financial records.

Put assets into cryptocurrency-focused reserves

If you would prefer not to pick among individual cryptocurrency associations, then you can decide to place assets into a cryptocurrency-focused resource taking everything into account. You have a choice of trade exchanged reserves (ETFs, for instance, document assets and possibilities reserves, notwithstanding an extent of cryptocurrency adventure trusts. Some crypto-focused reserves put assets into cryptocurrency clearly, while others put assets into crypto-focused associations or additional securities like possibilities contracts.

Put assets into a cryptocurrency IRA

If you want to place assets into cryptocurrency and at the same time acquire the obligation benefits oversaw by a singular retirement account (IRA), then you can ponder investing in a cryptocurrency IRA. Using the organizations of a crypto IRA provider can similarly work with a more certain limit regarding your cryptocurrency property.

Turn into a crypto digger or validator

Perhaps the most prompt strategy for investing in cryptocurrency is to mine it or go probably as a validator in a crypto network. Cryptocurrency diggers and validators obtain prizes in crypto, which they can either hold as hypotheses or trade for other money.