I’ve written articles previously about the future of green investing and this is another in the series that will shed some more light on this little-understood field. I’m concentrating in this article on carbon offsets and why they look to be one of the biggest investment opportunities for some time. There are two types of carbon emission reduction markets right now: voluntary and mandatory markets. The mandatory market is much larger and exists in countries that are following the Kyoto Protocol guidelines on carbon emission reduction into the atmosphere. The smaller market is the voluntary market which exists in countries like China, Australia, and the U.S. It’s this market that is interesting from an investment standpoint. The reason is that if, and it still is a bit of an “if,” the U.S. and China in particular adopt the Kyoto guidelines then the market for carbon offsets is going to increase at an incredible rate since China and the U.S. are the two biggest polluters in the world. And since there are now a fixed number of carbon reduction projects available in the world then the demand will quickly outstrip the supply leading to higher prices. Possibly much higher prices. That’s why smart investors are investing now in carbon offsets and anticipating this huge rise in prices. There are currently exchanges in the world where these credits can be easily traded so the credits are quite liquid. And you know when the big financial institutions get into the act that it’s time to start paying attention to any investment opportunity.

Many investment banks such as JP Morgan Chase, Morgan Stanley, Barclays, and Goldman Sachs have all entered the market place and although I stated above that this whole scenario is based on an “if,” you wouldn’t see these players in the market unless there was a real opportunity. Nearly every investment bank has set up an environmental markets division and there are now a host of funds that are dedicated to the sector. You know when the big boys get interested that there has to be a lot of money involved. These are just some of the reasons why we think that carbon offsets investing is going to be the most exciting investment opportunity for the next several years and why we are advising anyone to take a closer look at this market. It’s real, it’s growing, and now is the time to get involved. There are many more details that any smart investor would want to gather before making an informed decision and in any investment field, there are pearls and dogs.

However, taken as a whole this entire sector is poised to really take off soon and when it does the people who are in the right positions stand to make a lot of money. Our analysts are all bullish on the possibilities and I’m sure that after you take a good look at what’s happening you will be too. Good luck with your investment decisions.

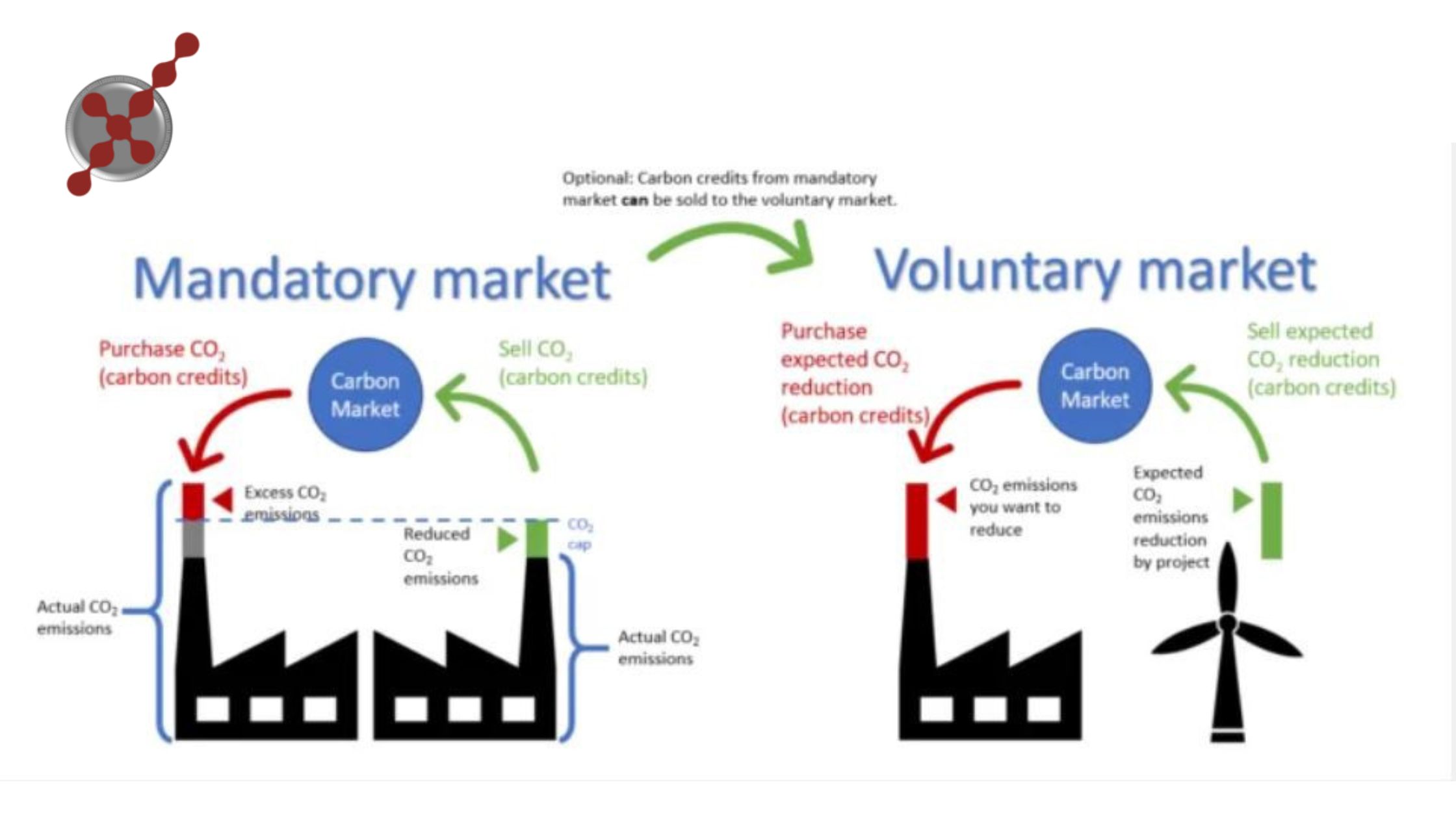

With all the stress on the environment today, carbon and greenhouse gas (GHG) reduction has become a major issue. With more than 20 million tons of carbon dioxide being produced globally each year; reducing carbon emissions, curtailing waste, and producing more clean energy is the call of the day. Eco-conscious individuals, businesses, and corporations are all striving towards reducing their carbon footprint. When emissions are reduced as much as possible or until it’s feasible to eliminate the carbon footprint, carbon offsets come into play. A carbon offset is a form of trading, specifically a credit for the reduction in harmful emissions not by the firm’s actions but through the work of another establishment. This credit is generated when the said establishment’s work results in a drop in the level of carbon dioxide or greenhouse gas emissions below a certain mandatory or voluntary cap. The mandatory/compliance cap is usually set by governments or an international body. Therefore, a carbon offset essentially lets an entity pay to reduce the level of these harmful pollutants rather than making any improbable or unachievable reductions on its own. These carbon offsets are traded on a local, national and global scale. An international network of retailers, brokers, and trading arenas exists to facilitate the buying and selling of these offsets. The offsets are normally measured in terms of a ton of carbon dioxide equivalents i.e. CO2e. Various activities can help create carbon offsets; for example, the use of renewable sources of energy such as wind power and biomass energy as well as participating in activities like reforestation and agriculture. The use of renewable energy systems can generate a tremendous carbon offset, due to the important fact that they eliminate the dependency on fossil fuels and virtually generate zero emissions. For more info visit our blog.